- Paradoxical world of global macro, short reflation and short spoos is not the same trade.

- The European barbell, politics is a left tail.

- UK v Europe, long policy flexibility v short policy constraints.

- Yen with a Fed backstop, a "free" claim on US assets?

- Does the Phillips Curve matter outside of income channel, it does.

Paradoxical world of global macro

There seems to be this tug of war in markets. On one side there is a wall of global savings with very few places to put it. On the other side there's a massive economic shock and output will likely contract around 10% this year.

And this is largely how the divide breaks down. There is a massive imbalance of capital v places to put it. Of course, the large cap v small cap divide breaks down beyond that as there will likely be a cannibalization process as the "strong" push out the "weak." With that said, if the argument is stuck in, valuations are expensive or the prospects for tech are limitless, that misses the broader macro trends.

The economy and market can and for a long time exist in a state of paradox. Are valuations absurd relative to economic risks, probably. Are equity valuations high enough to offset an insatiable demand for high quality US names from real money domestic and foreign, probably not.

So the real question going forward is, how does this tug of war resolve itself. It is interesting that recently the market has been very cautious around the 2900 level. Is that the level where the valuation/economic reality take over, maybe, but it is worth remembering the asset shortage is massive and the imbalance of capital relative to places to put it creates a lot of incentives to keep up with the things that have worked.

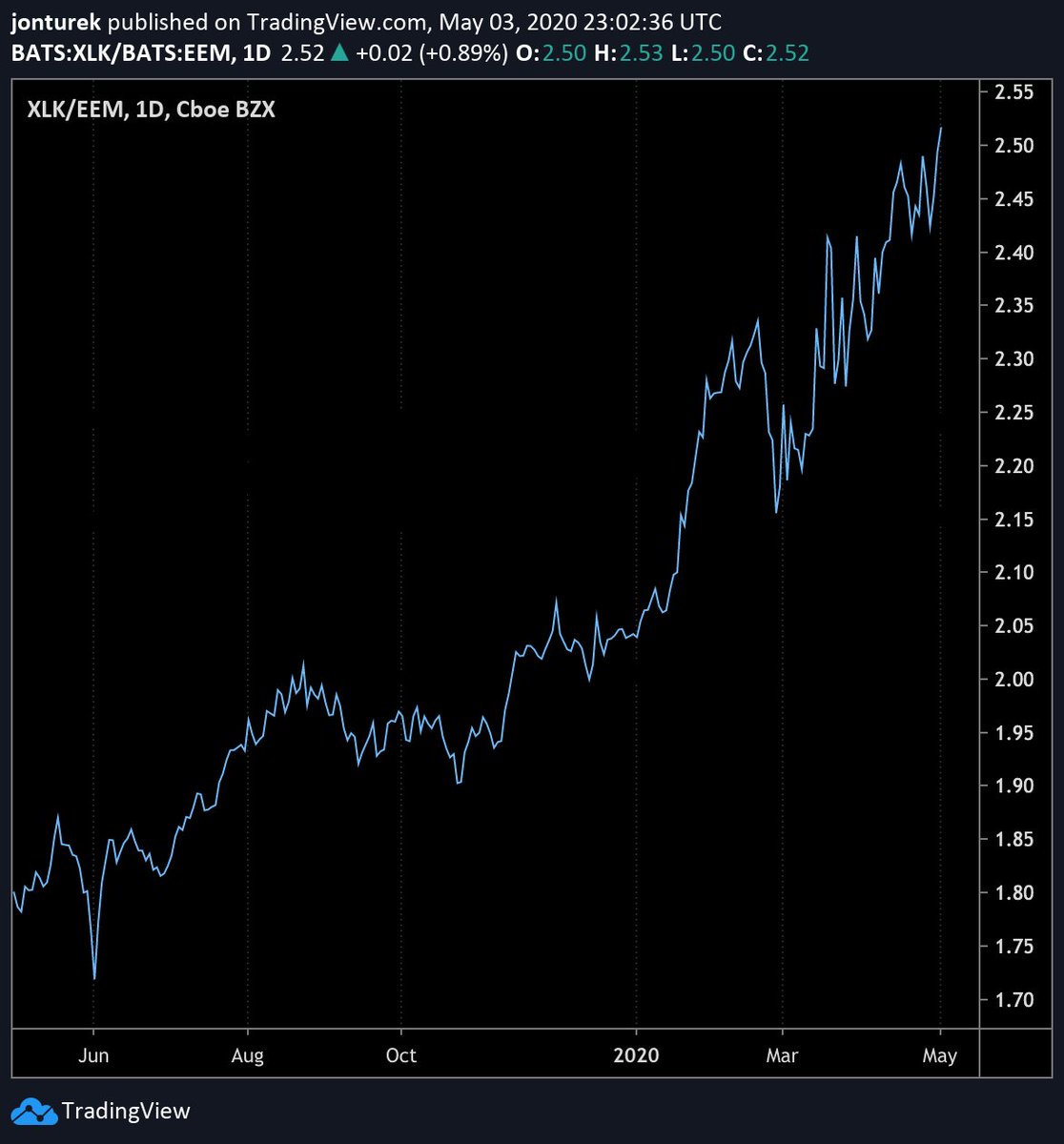

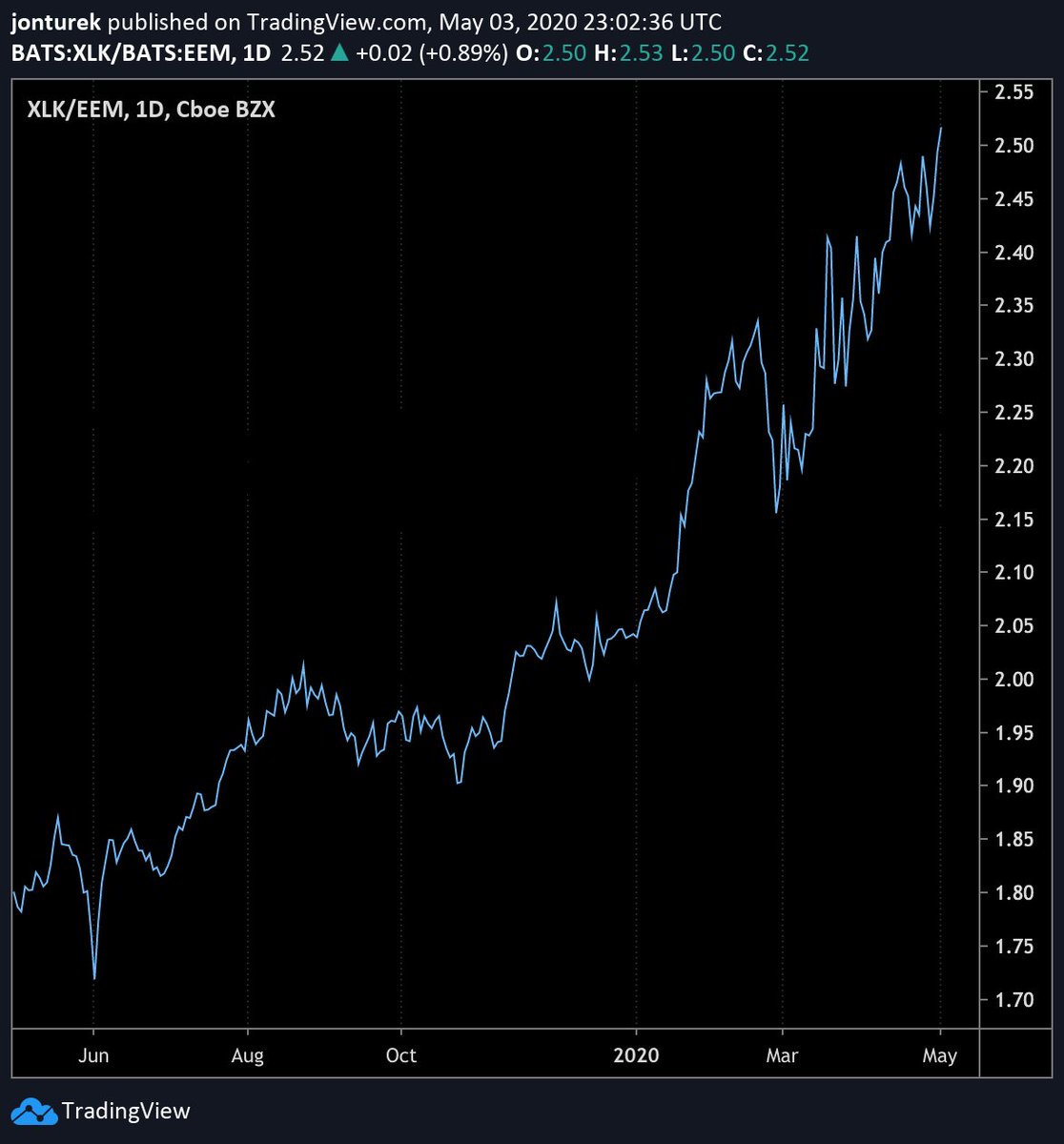

Overall: The combination of this dynamic, how economically regressive covid is, i.e. the poorer countries are more vulnerable, has set up this really interesting dynamic. My expression for this framework has been long tech short EM, or on twitter what I called the "cleanest chart in macro." The reality is, it plays on so many macro dynamics, from relative balance sheet capacity, distribution of economic outcomes, and capital flows in a global QE world.

Said in another way, I want be long "good" outcomes in US equities and "bad" outcomes in EMFX.

The European barbell, politics is a left tail

Tech v EM

The other way I have been thinking about this framework is, being short reflation and being long the market is not at odds with each other.

The European barbell, politics is a left tail

I have written a lot about a European barbell, an idea basically that Europe is at a key point and it basically has two options.

Two options:

1) The good one: some level of joint issuance either via mutualization or through commission bonds that allows for risk sharing among members. This would not only be crucial in terms of politics and solidarity but it would also provide the world a safe asset in a time of high demand for cash alternatives. This would be bullish EUR.

2) The not good outcome is, the northern countries don’t budge on some level of risk sharing and despite an aggressive ECB and a real backstop in the ESM, political backlash leads to fragmentation that the ECB will have a tricky time combatting. The point is, technicals aside, even with unconditionality, eurobonds and ESM are not interchangeable from a political perspective.

A muddle through might not work, the South has leverage this time

Another new dynamic this time is, the Italians have power and what if Italy throws a punch.

The creditor v debtor dynamic has changed, the periphery is no longer the "bad guy", that’s now the Northern countries and they don’t seem to get it. An exogenous shock has rocked the southern countries, one the Commission admitted to being late to, this isn't a situation where another round fiscal responsibility lectures will go over well.

This is a problem the market seems to be discounting. Of course within the distribution, the most likely outcome is some form of European muddle, as we have seen so far with the Commission recovery fund that does propose some grants. However, the difference this time is, not that a muddle wont work, but it may have tangibly negative political repercussions, and relatively soon. The political terms seem a lot more binary.

Two options:

1) The good one: some level of joint issuance either via mutualization or through commission bonds that allows for risk sharing among members. This would not only be crucial in terms of politics and solidarity but it would also provide the world a safe asset in a time of high demand for cash alternatives. This would be bullish EUR.

2) The not good outcome is, the northern countries don’t budge on some level of risk sharing and despite an aggressive ECB and a real backstop in the ESM, political backlash leads to fragmentation that the ECB will have a tricky time combatting. The point is, technicals aside, even with unconditionality, eurobonds and ESM are not interchangeable from a political perspective.

A muddle through might not work, the South has leverage this time

Another new dynamic this time is, the Italians have power and what if Italy throws a punch.

The creditor v debtor dynamic has changed, the periphery is no longer the "bad guy", that’s now the Northern countries and they don’t seem to get it. An exogenous shock has rocked the southern countries, one the Commission admitted to being late to, this isn't a situation where another round fiscal responsibility lectures will go over well.

This is a problem the market seems to be discounting. Of course within the distribution, the most likely outcome is some form of European muddle, as we have seen so far with the Commission recovery fund that does propose some grants. However, the difference this time is, not that a muddle wont work, but it may have tangibly negative political repercussions, and relatively soon. The political terms seem a lot more binary.

Mutualization type = support and solidarity, ESM type even with unconditionality = you don't care.

If Conte is going to try and sell the people on another classic pathchwork European backstop, this sets up a worrying development. Either the Italian government decide they do not want to sell this or they do and it is rejected via domestic political turmoil. I.e. if a bandaid is the European response, it could get pulled off pretty quickly.

The question is, how do you bet on unfortunate outcomes in Europe. The currency is tricky because that surplus is such a floor in risk off. Despite asymmetry, BTPs are hard to short given the ECB bazooka with PEPP, that will likely get bigger. Sure Lagarde left a lot to be desired last week. but the ECB is there to tighten spreads and the market knows it. So there are two dynamics, there is a tail in Europe that is still likely underpriced, but given structural dynamics within the EMU (current account and APP) its not clean to bet it. The answer may be short CEE FX, short EMU beta.

CHFPLN daily chart (LHS). GBPCZK monthly with 5y moving average (RHS).

Central European economies face a very precarious future, especially if the EMU is going to muddle through this. What is the CEE model. They get trade and funds from EU, it eats up domestic slack (tight immigration), raised rates relative to EMU (CZK), carry etc leads to recycling. The problem now is, the export car parts to Germany so that they can export cars to China, is not an ideal economic model. Since 2002, Poland/Czech/Hungary, have seen their nominal export levels rise by 2-4.2x. Integration has been a great trade for CEE.

As these globalization and global trade tailwinds have transitioned into headwinds, these currencies have to get fundamentally cheaper. And this all before their respective local political situations.

UK v Europe, long policy flexibility and short policy constraints.

I wrote last time why GBP is an interesting story. In theory, when UK eases, GBP gets killed because of current account, external debt etc. This time around, GBP has stayed relatively bid, even with one of the more aggressive monetary/fiscal mixes. The thesis I presented last time was that the market could be “rewarding” the UK for being less constrained than say Europe, which gives it a sort of 1931 feel in terms of the UK breaking free of policy constraints.

UK stocks v France (EWQ) & Italy (EWI), some interesting weekly moving averages.

Yen with a Fed backstop, a "free" claim on US assets.

There are a few interesting dynamics within JPY right now:

1) The Fed helped out GPIF. Dollar liquidity has allowed to them fund/hedge and Fed's backstop of IG has protected their positions. Fed will keep bills-ois in tact and try and prevent it from spilling into unsecured markets. This has been the pressure point for Yen and the Fed is on top of it. As long as BoJ is getting liquidity to end users, the pension/lifer sector, JPY should avoid another flare up.

2) Without technical dislocations in FX swap market, is Japan's NIIP position just a "risk free" claim on US asset prices. Now, especially if the Fed does YCC, why would GPIF take more naked FX risk unless instructed to do so by the BoJ (stealth intervention).

3) Everyone is at lower bound, Japanese FX policy from MoF/BoJ was not designed for that.

The question for Japan now is, how do they weaken Yen. The original catalyst for Yen weakness into this crisis was, Japanese bank and non bank sectors have a ton of dollar funding needs, which has explained the massive BoJ take up of the Fed's swap line. But, given how interest rates everywhere have converged to zero and deflationary risks from the demand shock have lowered expected inflation, it is very hard for JPY to weaken.

Yen v surplus Asia could be an interesting dynamic, sort of a lag trade at this point. As we have documented, a lot of surplus Asia is similar to Japan in a NIIP sense. They have a ton of excess savings that overwhelms size of domestic market so needs to be exported. However, unlike Japan, none of these countries have made the painful export adjustment (Japan is still in it). Exports accounting for 50% of GDP is not the way of the future. So many of these Asian countries are in for an adjustment, likely a fiscal one. So yes, both Japan and surplus Asia have massive NIIP positions which should support FX valuations, but relative to Japan, many of them still have to make broader economic adjustments.

This chart is super interesting. JPYKRW.

Does the Phillips Curve matter if income has been replaced?

This is a bit wonky but it fits into my framework for that reflation and rising asset prices are not the same thing. The question is, why has deflation been ruled out.

Few potential reasons:

1) Even if the Phillips Curve is alive, the income channel has been replaced via stimulus. Goldman did a great chart documenting that as a first order shock absorber to spending, stimulus has prevented a disaster in incomes.

2) It didn't happen in 2009. The new Keynesian model told to us to look through current slack. Future marginal costs matter more than current economic activity. I.e. there is this form of discounting which leads to stickiness. And that is why the a DSGE based on NKPC would not have forecasted deflation post GFC.

3) The most accepted reason in policy maker circles is, the flatness comes from a lack of variance in inflation given how successful monetary policy has been in anchoring expectations.

4) the price PC slope has flattened because both wages and prices are changed less often. Once variance decreases, stickiness increases and the response to changing labor market dynamics is smaller.

5) Empirical bias. As the unemployment rate got lower and lower, and past any SEP estimate of NAIRU, the conclusion from policy makers was, the price PC still lives, but the slope is just much flatter than we assumed.

What if policy makers are too confident the PC is dead or irrelevant given income replacement.....

Yes, a lack of variance in prices seemingly has become self fulfilling. But there seems to remain risks that we buried the Phillips Curve at the wrong time. Maybe, it's not dead, maybe it's just asymmetric. And yes, income has largely been replaced by stimulus this time around. But, there is still a lot of behavioral differences between someone who is employed v unemployed. Healthcare, risk aversion, expectations. I.e. you can replace income, but the impulse is fundamentally different.

This a rough example where you take average PC slope during two "best" years of recovery v two "worst" years of downturn. Plenty of problems with this approach, but does convey an interesting point that should be pretty intuitive. Of course, in these episodes the fiscal stabilizers were nowhere near as big as they are today.

This is why I am surprised the Fed has been relatively slow in changing its forward guidance that is far too delphic v ZLB risks. The current idea seems to be it is too early and the Fed at this point doesn't need to convince the market of much.

I think the right framework for where the Fed is going in this regard comes from Brainard's February speech. Her idea is that we should have aggressive outcome based forward guidance along with interest rate caps, creating what Brainard calls, "the commitment mechanism." This is really interesting because both of these policies have merit on their own, especially at the ZLB, but together, they kill two birds with one stone. Cap yields, strong odyssean guidance, and together they reinforce each-other. I think this the framework the Fed will adapt, whether at June SEP or Jackson Hole, but sooner than later.

If Conte is going to try and sell the people on another classic pathchwork European backstop, this sets up a worrying development. Either the Italian government decide they do not want to sell this or they do and it is rejected via domestic political turmoil. I.e. if a bandaid is the European response, it could get pulled off pretty quickly.

The question is, how do you bet on unfortunate outcomes in Europe. The currency is tricky because that surplus is such a floor in risk off. Despite asymmetry, BTPs are hard to short given the ECB bazooka with PEPP, that will likely get bigger. Sure Lagarde left a lot to be desired last week. but the ECB is there to tighten spreads and the market knows it. So there are two dynamics, there is a tail in Europe that is still likely underpriced, but given structural dynamics within the EMU (current account and APP) its not clean to bet it. The answer may be short CEE FX, short EMU beta.

CHFPLN daily chart (LHS). GBPCZK monthly with 5y moving average (RHS).

Central European economies face a very precarious future, especially if the EMU is going to muddle through this. What is the CEE model. They get trade and funds from EU, it eats up domestic slack (tight immigration), raised rates relative to EMU (CZK), carry etc leads to recycling. The problem now is, the export car parts to Germany so that they can export cars to China, is not an ideal economic model. Since 2002, Poland/Czech/Hungary, have seen their nominal export levels rise by 2-4.2x. Integration has been a great trade for CEE.

As these globalization and global trade tailwinds have transitioned into headwinds, these currencies have to get fundamentally cheaper. And this all before their respective local political situations.

UK v Europe, long policy flexibility and short policy constraints.

I wrote last time why GBP is an interesting story. In theory, when UK eases, GBP gets killed because of current account, external debt etc. This time around, GBP has stayed relatively bid, even with one of the more aggressive monetary/fiscal mixes. The thesis I presented last time was that the market could be “rewarding” the UK for being less constrained than say Europe, which gives it a sort of 1931 feel in terms of the UK breaking free of policy constraints.

UK stocks v France (EWQ) & Italy (EWI), some interesting weekly moving averages.

Yen with a Fed backstop, a "free" claim on US assets.

There are a few interesting dynamics within JPY right now:

1) The Fed helped out GPIF. Dollar liquidity has allowed to them fund/hedge and Fed's backstop of IG has protected their positions. Fed will keep bills-ois in tact and try and prevent it from spilling into unsecured markets. This has been the pressure point for Yen and the Fed is on top of it. As long as BoJ is getting liquidity to end users, the pension/lifer sector, JPY should avoid another flare up.

2) Without technical dislocations in FX swap market, is Japan's NIIP position just a "risk free" claim on US asset prices. Now, especially if the Fed does YCC, why would GPIF take more naked FX risk unless instructed to do so by the BoJ (stealth intervention).

3) Everyone is at lower bound, Japanese FX policy from MoF/BoJ was not designed for that.

The question for Japan now is, how do they weaken Yen. The original catalyst for Yen weakness into this crisis was, Japanese bank and non bank sectors have a ton of dollar funding needs, which has explained the massive BoJ take up of the Fed's swap line. But, given how interest rates everywhere have converged to zero and deflationary risks from the demand shock have lowered expected inflation, it is very hard for JPY to weaken.

Yen v surplus Asia could be an interesting dynamic, sort of a lag trade at this point. As we have documented, a lot of surplus Asia is similar to Japan in a NIIP sense. They have a ton of excess savings that overwhelms size of domestic market so needs to be exported. However, unlike Japan, none of these countries have made the painful export adjustment (Japan is still in it). Exports accounting for 50% of GDP is not the way of the future. So many of these Asian countries are in for an adjustment, likely a fiscal one. So yes, both Japan and surplus Asia have massive NIIP positions which should support FX valuations, but relative to Japan, many of them still have to make broader economic adjustments.

This chart is super interesting. JPYKRW.

Does the Phillips Curve matter if income has been replaced?

This is a bit wonky but it fits into my framework for that reflation and rising asset prices are not the same thing. The question is, why has deflation been ruled out.

Few potential reasons:

1) Even if the Phillips Curve is alive, the income channel has been replaced via stimulus. Goldman did a great chart documenting that as a first order shock absorber to spending, stimulus has prevented a disaster in incomes.

2) It didn't happen in 2009. The new Keynesian model told to us to look through current slack. Future marginal costs matter more than current economic activity. I.e. there is this form of discounting which leads to stickiness. And that is why the a DSGE based on NKPC would not have forecasted deflation post GFC.

3) The most accepted reason in policy maker circles is, the flatness comes from a lack of variance in inflation given how successful monetary policy has been in anchoring expectations.

4) the price PC slope has flattened because both wages and prices are changed less often. Once variance decreases, stickiness increases and the response to changing labor market dynamics is smaller.

5) Empirical bias. As the unemployment rate got lower and lower, and past any SEP estimate of NAIRU, the conclusion from policy makers was, the price PC still lives, but the slope is just much flatter than we assumed.

What if policy makers are too confident the PC is dead or irrelevant given income replacement.....

Yes, a lack of variance in prices seemingly has become self fulfilling. But there seems to remain risks that we buried the Phillips Curve at the wrong time. Maybe, it's not dead, maybe it's just asymmetric. And yes, income has largely been replaced by stimulus this time around. But, there is still a lot of behavioral differences between someone who is employed v unemployed. Healthcare, risk aversion, expectations. I.e. you can replace income, but the impulse is fundamentally different.

This a rough example where you take average PC slope during two "best" years of recovery v two "worst" years of downturn. Plenty of problems with this approach, but does convey an interesting point that should be pretty intuitive. Of course, in these episodes the fiscal stabilizers were nowhere near as big as they are today.

This is why I am surprised the Fed has been relatively slow in changing its forward guidance that is far too delphic v ZLB risks. The current idea seems to be it is too early and the Fed at this point doesn't need to convince the market of much.

I think the right framework for where the Fed is going in this regard comes from Brainard's February speech. Her idea is that we should have aggressive outcome based forward guidance along with interest rate caps, creating what Brainard calls, "the commitment mechanism." This is really interesting because both of these policies have merit on their own, especially at the ZLB, but together, they kill two birds with one stone. Cap yields, strong odyssean guidance, and together they reinforce each-other. I think this the framework the Fed will adapt, whether at June SEP or Jackson Hole, but sooner than later.

Hey Jon interesting post - alot of discussion on Japanese lifer responses to the Fed actions and the feeling is they will begin running FX hedges going fwd as opposed to outright USD buying....so you think the risk is of a stronger YEN against most pairs now? Lower USDJPY higher JPYKRW etc..? Bc the flip side to that is I am hearing there is plenty of cash sitting on the sidelines in Japan and people are just not investing/spending - its literally cash under the mattress. Compounded with a slowing economy, usual demographic issues, and a debt ratio that will likely force a jubilee of sorts the sense I am getting from Japanese investor is a move to 150++ in USDYEN next 5-7 yrs.

ReplyDelete