The one trade now in global macro is, can policymakers continue to get whatever outcomes they want.

Sections:

Sections:

- For the market, skew has mattered more than expectations

- Macro in a world of policy omnipotence

- The last idiosyncratic rates trade, China

- Is the JGB curve ironically the best DM steepener

For the market, skew has mattered more than expectations

One of the things that has seemingly been missed in this market is, the narrative has been focused on outcomes while the market has been pricing skew. I think over the past few months there have been a few examples of this.

- EUCO recovery fund. The narrative at the beginning of the process after the M&M press conference on May 18th, the size is not big enough. What has the market reaction been? the precedent of European fiscal transfers is a far more important development than the actual size of the recovery fund. As we have learned in Europe, it is harder to start something than to make it bigger, ask Mario Draghi.

- In the US, fiscal stimulus was supposed to struggle to cap the revenue drop caused by the unprecedented nature of this crisis. To an extent, it has, but what this narrative missed in a distributional sense is, the policy response to deflationary shocks has changed and the left tail has been clipped. The government sends out money and the central bank does open ended QE. Does this mean future growth is promised, no, but it does change the recession landscape in terms of size and duration.

- The US dollar is another example of this. How was the Fed going to downstream dollars to EM corps and Asian non banks. And then from there, was there really going to be a change in global growth composition that would change the USD "smile" world where US asset outperformance continues in perpetuity. Would previously frugal surplus countries step up with ambitious fiscal plans that would not only plug the covid hole but transcend the current crisis and serve as an economic accelerant going forward. The immediate answer to a lot of these questions was, the most probable outcome is no, but the market traded the skew and thats where we are today.

Going forward, I'm not sure what changes the current risk dynamic. I think a very interesting dynamic has been the fact that a weak dollar has not elicited a response from the long end of the US bond market. This may speak to the asymmetry we see in the current relationship. When the dollar is strong it weighs on global NGDP and thus term premium. When the dollar is weaker, FX basis tightens, and it again makes sense for foreign real money to buy the long end FX hedged to get a yield pickup over its local government bond equivalent. This latter dynamic is like rocket fuel for risk assets, especially EM, as all the stimulative effects of a weaker dollar, trade finance etc. can happen without a commensurate move up in term premium. This is the dream for EM. The question now is, after a pretty substantial move lower in the dollar, does it make sense to have some tactical stuff against core positions that have a risk bias. I think the places to look for this sort of exposure is CBs that have already said they don't want further FX appreciation (ILS, THB, TWD).

Macro in a world of policy omnipotence

One of the more amazing transitions in markets since March has been the market's outlook towards policy. In the darker days of March, the Fed was "constrained" by the effective lower bound and fiscal was too slow. So the bet was, this shock would overwhelm policy. Fast forward to now, and the market has basically said no shock is too big for policy makers and if that is the case, we just gravitate towards the right side of the risk distribution as the policy put is struck so high.

Where we are now is, the market asks itself what the Fed wants and then puts those trades on. What are those trade:

- The Fed wants a weaker dollar. They turned every world government bond market into USD to prove that.

- The Fed wants IG to trade at new tights. Allowed record IG issuance three months in a row. Liquidity that prevents solvency issues.

- The Fed wants risk assets higher to ensure smooth financial market functioning for the real economy.

- The Fed wants real yields to plummet which effectively allows their easing footprint to expand with improvements in the outlook. Pro cyclical policy.

We are now in the market cycle of, the Fed can do what it wants, so the only thing to figure is what it wants to do.

The next stage of this understanding is in Brainard's speech from last week. The theme of that speech was the transition from "stabilization to accommodation". But I will translate that differently: we got nominal yields where we want them, now the policy focus is on real yields.

A key theme in the speech was this transition of, "stabilization to accommodation." What does that look like. Well, we know from pre covid, at the ZLB, Brainard was in favor of using ycc to reinforce forward guidance. However, "stabilization to accommodation" has further consequences. This theme of transition is right out of the Benoit Coeure playbook. During the stabilization period, what is important, as Coeure put it, is for the central bank to "put its money where its mouth is." QE plays outsized role and has a higher multiplier. Then the transition happens, to accommodation. QE multiplier falls as policy has succeeded in shifting upwards the distribution of risks around the growth outlook. This is when strong odyssean or outcome based forward guidance is most efficacious and asset purchases serve as reinforcement for forward guidance. “As the outlook improves, the signal that asset purchases send regarding the likely date of a first rate hike becomes increasingly important for anchoring the medium to long-term segment of the curve.” This is where the Fed is: they have cutoff the mechanism in which good news is priced into any part of the yield curve and they plan on reinforcing that, whether that is outcome based forward guidance with curve caps or not, I'm not sure it will matter. The market already knows. The Fed’s policy goal is to prevent bad things and accentuate good things.

So the skew for real yields is still towards going further negative. A few things:

- The market has transitioned from thinking policy can't respond to this size of a shock, to where it is now, policy can do anything. Betting on rising real yields is basically a bet policy is outmatched versus the size of the shock. That has been the wrong bet.

- Assuming my previous note about the dollar being a solved problem is in the ballpark, the chances of a runaway dollar clogging up the financial plumbing and constricting trade finance again has been severely reduced.

- The traditional Phillips Curve is dead. Maybe the New Keynesians have it right (marginal cost driven as opposed to slack). In fairness, they did tell us to look through current slack. Future marginal costs matter more than current economic activity. I.e. there is this form of discounting which leads to stickiness. But either way, in a world that policy makers are going to be expected to replace lost incomes, the distribution of potential economic outcomes is changed.

One of the things that weighed so heavily on bonds and breakevens in the prior decade was the asymmetry of deflation. When the economy was doing well, inflation did nothing, so imagine what would happen in a recession. That skew has fundamentally changed in a world where lost income is replaced to a certain extent and recoveries are unencumbered by premature stimulus withdrawals.

I'm not sure what stops this chart unless the market is to reevaluate its views on USD. Real yields and precious metals by extension are a just bet on continued policy omnipotence.

The last idiosyncratic rates trade, China

One of the more interesting and frustrating government bond markets in the world has been China. Yields in China seem to be the only place where the market is taking the "V" seriously. And when it comes to things like TSF (total social financing) and industrial production in China, it has been pretty "V" like. To add to this, China following the NPC let rip a special CGB issuance which the NPC fast tracked. Without a big RRR cut and other liquidity measures from the PBoC which were evidently absent, it zapped all the liquidity from the market and yields backed up a lot and the fixing rate from 1.5% to over 2.2%.

The question now is, are Chinese rates the place to receive and get some counter risk exposure. I have been burned on this trade before, but in terms of asymmetry, it ticks all the boxes. The Chinese "V" in industrial activity is more than priced and TSF numbers have likely made policy makers a bit nervous which could see the Q3 numbers come down. And finally, the PBoC is now adding a lot of liquidity even if it is not cutting rates such as the MLF or OMO. Since last week, the net injection of reverse repos has been over 230b RMB. To me, at a minimum this is policy makers saying, rates have gone far enough. And if that is the case, you get some negative equity correlation with a good risk reward.

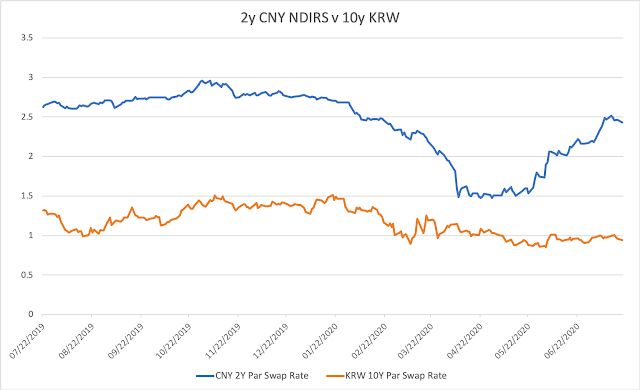

A trade I am really interested in is a cross currency steepener with Korea. Basically the idea is, if Chinese industrial activity is again leading the global economy out of covid, then the backend of Korea should begin to reflect that. So if this is a China led reflation, 10y KRW below 1% is probably wrong. On the flip side, in risk off, Chinese 2y above the fixing rate will move a lot. The point of this trade is, you are vol-adjusted received, and in case reflation goes into third gear, you're paid some duration and hoping the front end of China still sticks towards the fixing.

Is the JGB curve ironically the best DM steepener?

Not so many people spend much time on JGBs anymore, and probably for good reason, it's barely a market at this point. With that said, there seem to be a few interesting parts to the market, especially given the external backdrop.

Going back at least a year, in the very front end (tbills) and the very long end, there has been a lot of interesting things going in JGBs, even if YCC has crushed everything in between

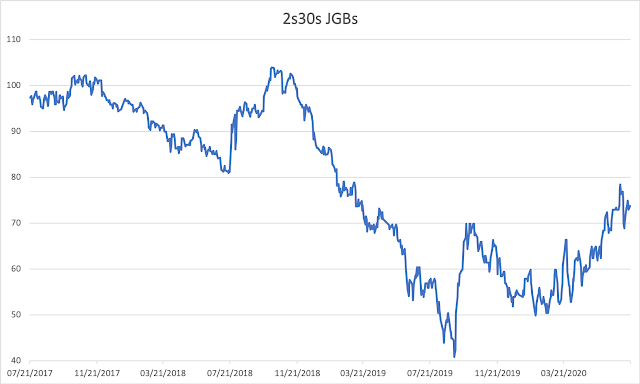

- In the long end, the BoJ has not been shy about encouraging steepness in the name of financial stability. This has been clear in FSR's (financial system report) and Rinban schedules of long end purchases. The BoJ is firmly aware that too flat of a curve is a problem for its bank/saving heavy economy. Throw on covid and budget blowout after at least two supplementary budgets, it makes sense the curve has steepened quite a lot, especially in the back end.

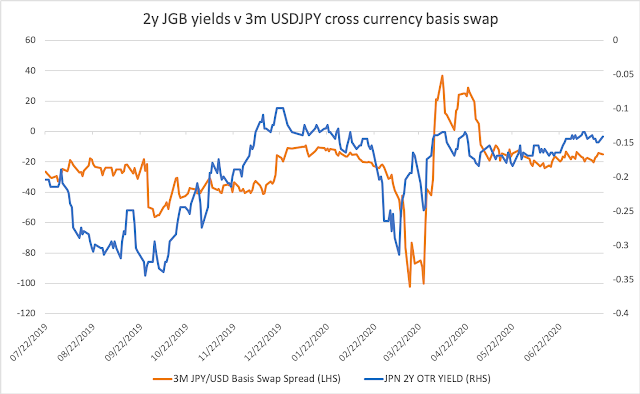

- In the short end, something else has been going on over the past couple years ago and it explains why foreign ownership of JGBs has soared. Basically, as Japan was one of the biggest users in the FX swap market in terms of funding/hedging USD, its cross currency basis swap spread traded very negative. Because of this dynamic, money would come into the FX swap market to take advantage of this very negative spread. What happens is, money comes in to take the other side of Japanese lifer/pension money looking for USD, usually at 3m point. Lifers would swap Yen for USD, to either US banks or reserve managers sitting on USD. Now, with all that Yen, these players would then buy Japanese tbills, which because of the negative xccy created a massive yield pickup over equivalent treasuries or bunds. However, given where FX basis trades now, the Japanese carry trade is a bit less compelling.

This dynamic could set Japan up to actually be the most asymmetric steepener out there. What we have seen so far is, as it relates to DM curves is, anything with carry and rolldown gets taken in, which explains the foreign bid in ACGBs. However, the background of that is, if FX basis is normalized, Japan can go back to getting foreign hedged yield pickup abroad, which will weigh on the long end in JGBs. Basically the point of this is, 2s30s Japan is being encouraged to steepen by both policy makers and dynamics within the financial plumbing. It can't go forever, but Japan may ironically be the place to steepen.

Japan more so than anyone else explicitly wants steepness in the curve and some of the technical backdrops may go to reinforce that bias. Of course there will be cuteness with overseas buying of JGBs on asset swap to take advantage, but the bias of the long end of the curve is to steepen and Kuroda wants the same thing.

@jturek18, jonturek@gmail.com

how does lowering real rates help with anything.

ReplyDeleteFinancial repression - force investors to move up the risk curve and pile into equities, thereby help the wealth effect and stimulate consumer spending/GDP (Fed’s theory anyway)

Delete